With Andorra and Liechtenstein already written about, it’s time for the third and final principality: Monaco.

With Andorra and Liechtenstein already written about, it’s time for the third and final principality: Monaco.

Situated on the beautiful French riviera, Monaco is one of the most harshly criticised tax havens, for long having turned a blind eye to everything but the worst of crimes.

While no coverage of tax havens would be complete without Monaco, this article will not be particularly in-depth simply because there isn’t a lot to say about Monaco.

Sometimes confused for being a part of France, Monaco is a sovereign nation, having been so since 1861.

Geography and Demography

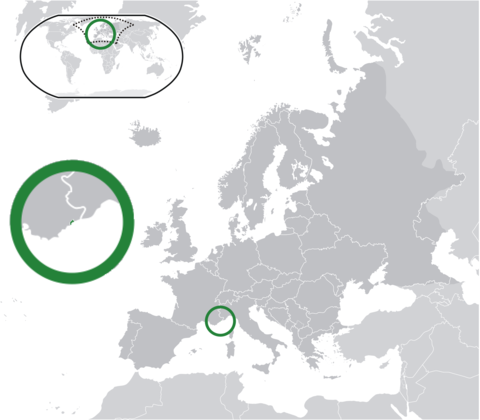

Map from Wikipedia.

;

Full Name:;Principauté de Monaco (Principality of Monaco)

Official language(s):;French

Other major languages:;Monégasque

Type of government:;Principality

Area:;2.02 km²

Timezone:;UTC+1

Population:;37,000

GDP per capita:;163,000 USD

Currency:;Euro (EUR)

[/table]Incorporation and Business

Reputation

Monaco is not known as being an international business center of any note.

General Information

Setting up a company is a lengthy process and wholly unattractive for a non-resident. Few governments are as intrusive and cumbersome to deal with as the Monegasque when it comes to starting a business. Companies will almost always require a permit.

This is not a business-friendly jurisdiction.

Despite this, the Monegasque authorities have taken the time to create a rather complex system of different legal forms, mainly:

- Société à Responsabilité Limitée (SARL)

- Société en Nom Collectif (SNC)

- Société en Commandite Simple (SCS)

- Société Anonyme Monégasque (SAM)

For a comparison of the different entities, I will refer to the government website.

Taxation

Irrespective of type of legal entity, the corporate tax rate in Monaco is 33% if the company generates more than 25% of its income outside of Monaco.

Companies are exempt from tax for the first two years. From the third year, 25% of the company’s profits are taxable. This goes up to 50%, 75%, and finally 100% for the next three years and on.

This leads to an effective tax rate as follows:

- Year 1: 0%

- Year 2: 0%

- Year 3: 8.3325%

- Year 4: 16.665%

- Year 5: 24.9975%

- Year 6 and on: 33.33%

While this may make Monaco appear attractive for the first two (if not three or even four) years, the costs of setting up a non-resident Monegasque company as astronomical. It offers no apparent advantage over other low-tax jurisdictions.

Public Records

Directors and members appear in government records.

Monaco Trust

Governed by Law 214, Monaco only recently recognizes international trusts and now allow trusts to be managed from within Monaco.

Foreign judgements, including ones for forced heirship, can be honoured.

Monegasque courts are eratic and unreliable in rulings related to trusts.

Depending on the number of beneficiaries, trusts are subject to a registration duty between 1.3% and 1.7%, unless the trust is established by a will in which case inheritance tax (see below) applies.

Monaco Foundations

Monaco recognizes international foundations.

While foundations can be set up in Monaco, they can only be set up for public or charitable purposes.

Banking

This is the sole significant contributor to Monaco’s tax haven status. Long famed for no-questions-asked type banking, Monaco is often associated with wealthy tax-dodgers, often celebrities such as famous athletes and entertainers.

Why the association? Because hardly a month goes by without some sports star or sports related higher-up getting busted in Monaco. It’s not the banks’ fault. It’s often a case of poor financial advisement and poor personal discretion.

The lavish lifestyle of Monaco blends poorly with the discretion necessary to keep finances private, it seems.

Banks in Monaco are often of high calibre. It’s all about private banking and it starts at 250,000 EUR minimum (often 1 million EUR).

Account opening is usually done remotely by visiting the bank in another country or through an intermediary.

Banking Secrecy

Banking secrecy in Monaco used to be a selling point but today it has eroded significantly after harsh criticism in the 2000s. The authorities are empowered to compel banks to disclose information under TIEAs.

Unfortunately, this relaxation in banking secrecy has not done much to improve on Monaco’s reputation.

Monaco still lacks treaties for exchange of information with many jurisdictions that are interested. With only 23 TIEAs and 8 DTAs signed, Monaco’s tax treaties are low in number for such a high-profile and heavily scrutinized tax haven.

Banks in Monaco

There are 18 banks incorporated in Monaco, the vast majority of which are foreign:

- Andbanc (Andorra)

- Bank Julius Bär (Switzerland)

- Banque Européenne du Crédit Mutuel (France)

- Banque Havilland (Luxembourg)

- Banque J. Safra Sarasin (Brazil, Switzerland)

- BNP Paribas (France)

- BSI (Switzerland)

- CFM (Monaco)

- Compagnie Monégasque de Banque (Monaco)

- Crédit Mobilier de Monaco (Monaco)

- Credit Suisse (Switzerland)

- Edmond de Rothschild (Switzerland)

- EFG Bank (Switzerland)

- HSBC (UK)

- KBL (Luxembourg)

- Martin Maurel Sella Banque Privée (France)

- Société Générale (France)

- UBS (Switzerland)

Additionally, there are 17 branches of foreign banks:

- Banca Popolare di Sondrio (Switzerland, Italy)

- Banque Martin Maurel (France)

- Banque Populaire Côte d’Azur (France)

- Barclays Bank (UK)

- BNP Paribas (France)

- CIC (France)

- Crédit Agricole Provence Côte d’Azur (France)

- Caisse d’Epargne Côte d’Azur (France)

- Coutts & Co (UK)

- Crédit Foncier de France (France)

- Crédit du Nord (France)

- LCL (France)

- La Banque Postale (France)

- Société Générale (France)

- Société Marseillaise de Crédit (France)

- Société de Paiements PASS (France)

- UBP (Switzerland)

There is also a plethora of asset management companies.

Living in Monaco

EU and EEA nationals can settle in Monaco freely. Despite being nearly completely tax free, Monaco is not worried about being overrun by tax savvy EU and EEA citizens seeking fortune. The costs of living in Monaco are very high and it’s difficult to find a place to live.

However, living in Monaco is as enjoyable as it is expensive.

If an exuberant life of luxury and decadence is what you are after and have the financial means for, Monaco just might be the place you want to call home.

Monaco offers great tax incentives to residents, except for French nationals who are subject to French taxation even when resident in Monaco.

There is no income tax, capital gains tax, or wealth tax.

Gift and inheritance tax may apply, depending on the relation between the parties. Exemptions are generally made for gifts or inheritances to spouses or various charitable activities or public services. Otherwise, the tax rate varies from 8% to 16%.

Monaco has signed the EUSD, meaning that EU withholding tax is levied on non-residents residing in the EU.

VAT is the same as in France.

There are number of registration duty taxes, such as real estate transfer (4.5% or 7.5%) and transfer of shares (1% or 4.5%).

Final words

I told you it would be short.

Come here to bank if you for some reason don’t want to bank in Switzerland, Liechtenstein, Andorra, or outside of Europe.

If you are looking for a jurisdiction suitable for business activities or asset protection, keep looking.

See also

- OECD Peer Review of Monaco (also has a list of TIEA and DTA)

- Financial Secrecy Index Monaco

- FATF documents on Monaco

Hey Streber,

You recommended about CMB bank in Monaco- but here you say there is no reason to bank there.

I contacted them and they allow reputable jursidction- I need it for more safety and stability less then for private banking and their fees are not so high.

What do you think ?

My business is commerciale

Hi,

The point I was trying to get across about banking in Monaco is that it – in general – is nothing extraordinary and does not offer any advantages in and of itself over other jurisdictions.

But with that said, CMB seems to be a good bank. I have had good experiences with them so far at least, although very little for a trading business (commercial banking).