My favourite among the three Baltics republic, this marks the fourth time I write a post related to Estonia.

My favourite among the three Baltics republic, this marks the fourth time I write a post related to Estonia.

See previous articles:

- How to Open an Estonian Bank Account

- Jurist24 (Estonian incorporation agent)

- SEB (Estonia and Sweden)

Culturally closer to Scandinavian than the Baltics or Eastern Europe, Estonia has linguistically close ties to Finland and it was for long ruled by the Swedish Empire (back when such a thing existed) under mostly amicable conditions.

Estonia has even applied for membership on the Nordic Council. While it has not been granted membership yet, it does enjoy excellent relations with Scandinavia.

It joined both the EU and NATO in 2004 and abandoned the Estonian Kroon for the Euro in 2011. Estonia is host to the Cooperative Cyber Defence Centre of Excellence division of NATO, nicknamed Tiigrikaitse (Tiger’s Defence).

Tiigrihüpe

Estonia’s absorption into the Soviet Union was never de jure recognized internationally although de facto the world was resigned to the fact. After the Soviet Union fell, Estonia in 1996 started a project to invest heavily in computer and network infrastructure. This project was called Tiigrihüpe (Tiger’s Jump), from which the aforementioned NATO centre got its nickname.

The project is generally seen as tremendously successful, fostering Estonia into a well-established hotbed for software development and start-ups, such as Skype and TransferWise. Programming classes are mandatory in Estonian schools.

Swedish and Scandinavian investments were vital to the Tiigrihüpe’s success, and helped create the strong post-Soviet relations between across the Baltic Sea.

Geography and Demography

Map from Wikipedia.

;

Full Name:;Eesti Vabariik (Republic of Estonia)

Official language(s):;Estonian

Other major languages:;Russian, English

Type of government:;Parliamentary republic

Area:;45,000 km²

Timezone:;UTC+2

Population:;1.3 million

GDP per capita:;17,000 USD

Currency:;Euro (EUR)

[/table]Incorporation and Business

Reputation

Due to aggressive marketing by some service providers in Estonia, who do little more than invite Scandinavians (mostly Swedish) to come to Estonia to dodge taxes illegally, Estonia can sometimes sting a bit in the eyes of some Scandinavian regulators or just people in general.

According to the Basel Index, Estonia is the second lowest-risk country in the world when it comes to money laundering. This coupled with a Largely Compliant rating from OECD, Estonia enjoys a superb reputation globally.

Most have no idea it’s a tax haven (of sorts) and those who do know generally do not consider Estonia’s tax practices to be harmful. It is not a secretive jurisdiction.

General Information

Forming a company in Estonia is fairly cheap and can usually be completed in a week or two (often much faster). The cost of formation can usually be as low as a few hundred EUR, while still be dealing with a good service provider.

While other company forms exist, the OÜ (osaühing) form is by far the most popular. It is a limited liability company where ownership is divided by shares.

A minimum of one director and one shareholder is required. Corporate directors are not allowed and at least 50% of the directors must be resident in the EU, EEA, or Switzerland. Corporate shareholders are permitted.

Taxation

Estonian companies are sometimes marketed as tax free. This is misleading.

The corporate tax rate in Estonia is 20% for 2015, which is a little below the European average (20.24%). However, what sets Estonia apart from the rest is that only distributed profits are taxed.

Suppose your Estonian company has a profit of 500,000 EUR at the end of the fiscal year. Now let’s assume that you reinvest 400,000 EUR of that into the company. Only the remaining 100,000 EUR is distributed (paid out as dividends or other) and only that sum is considered taxable income. This would lead to a tax bill of 20,000 EUR on profits of 500,000 EUR, which is an effective tax rate of 4%. If you re-invest all profits into the company, the tax rate becomes 0%.

This clever piece of legislation was created with the intent to make businesses grow, and it’s worked.

It is however unclear how useful this is for an Estonian company operated and managed from another jurisdiction. The only way to benefit from this is if your local tax authority honours the Estonian law and tolerates taxation on distributed profits only. Interestingly, many (European) jurisdictions seem to do this but caution should be exercised to prevent abusive behaviour. Advice is as always highly recommended.

VAT registration is mandatory for businesses with a turnover greater than 16,000 EUR in a year.

Record Keeping

Record keeping is required and must be detailed. Non-resident companies usually outsource the bookkeeping, for a very reasonable rate.

Audits requirements are, to quote the Chamber of Commerce:

- any entity, if the amounts presented in the financial statements of the accounting year exceed at least two of the three following criteria (a consolidating entity applies the criteria to the consolidated numbers):

- revenue (or income) of EUR 2,000,000;

- total assets of EUR 1,000,000;

- average number of employees: 30

- any entity, if the amounts described above exceed at least one of the following criteria:

- revenue (or income) of EUR 6,000,000;

- total assets of EUR 3,000,000;

- average number of employees: 90.

The requirement for a review applies to companies that are not subject to the audit requirement, but exceed either:

- the limits in two or more of the followingcriteria:

- revenue (or income) of EUR 1,000,000);

- total assets of EUR 500,000;

- average number of employees: 15.

- or the limit at least in one of the following criteria: revenue (or income) EUR 3,000,000; total assets EUR 1,500,000; average number of employees 45.

Public Records

Everything goes on public record.

Estonia is on a very short list of jurisdictions which require public disclosure of beneficial owner, and not just directors and shareholders.

Banking

Banking in Estonia is superb. The sector is dominated by the Swedish banks SEB and Swedbank.

It used to be very easy to open non-resident personal accounts in Estonia (especially as an EU national) but it has become more difficult in recent months. The banks – especially SEB and Swedbank – will require a connection to Estonia. Being a frequent traveller to Estonia or wishing to invest in Estonia and the Baltics will satisfy banks in many cases.

LHV, BIGBANK, and Versobank are usually the more easy-going of the banks there.

Forming a business in Estonia seems to satisfy most banks, though, even if it is owned and operated outside of Estonia. It it is a trading company, it helps to offer the services or sell the goods in Estonia.

Foreign companies will face a very hard time with most banks.

Banking Secrecy

Estonia does not have any noteworthy banking secrecy. OECD did criticize Estonian banks in 2011 for not always knowing the UBO of companies. This has mostly been solved by now and banking in Estonia is a lot tighter than before.

Authorities have due access to banking records.

Banks in Estonia

There are nine banks licensed in Estonia. Parenthesis indicate country of origin and year of license being issued.

- BIGBANK (Estonia, 2005)

- DNB (Norway, 2012)

- Inbank (Estonia and Malta, 2015)

- Krediipank (Estonia, 1993), Bank of Moscow is a significant shareholder

- LHV (Estonia, 2009)

- SEB (Sweden, 1993)

- Swedbank (Sweden, 1993)

- Tallinna Äripanga / Tallinn Business Bank (Estonia, 1993)

- Versobank (Ukraine/Latvia/Russia/Cyprus, 1999)

Additionally, there are seven branches of foreign banks:

- Citadele Banka (Latvia)

- Danske Bank (Denmark)

- Folkia (Norway)

- Handelsbanken (Sweden)

- Nordea (Sweden)

- Pohjola (Finland)

- Scania Finans (Sweden)

Lastly, there is one representative office of a foreign bank: Baltikums Bank (Latvia).

Living in Estonia

I have spent considerable time in Estonia and I enjoy every chance I have to visit.

The success of the Tiigrihüpe is evident. The infrastructure is of high quality and short of faded and crackled paint on older buildings, it can sometimes be difficult to tell if you are walking around in a small town in the Nordics or Tallinn.

Costs of living are low and with a flat income tax of 20% (capital gains count towards normal income), Estonia isn’t a tax haven but it is nonetheless attractive.

VAT is set to 20% normal rate with a lowered rate of 9% for certain goods and services. Some specifically designated goods and services are exempt from VAT.

EU, EEA, and Swiss nationals can move to Estonia freely. Other nationals face more stringent requirements.

Estonian e-Residency

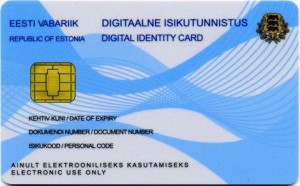

Estonia is a world leader in e-government. Estonians very rarely need to visit government authorities in person, instead doing all of their business online with their ID cards and special ID card readers connected to electronic devices. Again, a byproduct of the Tiigrihüpe.

Taking this one step further and as a way to attract even more foreign investment, Estonia has set up an electronic residency programme called e-Residency. It does not grant any special rights in Estonia. The purpose is to simplify due diligence for banks and other financial services providers in Estonia, and to enable an easy way to sign agreements, pay taxes in Estonia, et cetera.

Contrary to some misleading information, e-Residency does not in and of itself enable you to just start a company and open bank accounts in Estonia. It might simplify the process, though.

Anyone living anywhere can apply for e-Residency on the e-Estonia website. Once the application is submitted (which includes paying a fee of about 50 EUR), you will receive a confirmation email stating a deadline by which your application will have been processed (usually 10 working days).

If your application is approved, you need to go to the Estonian embassy you selected in your application process to complete the due diligence process. Some time later, you will be able to collect your ID card.

This means that although your ID card is not exactly a typical ID card (for one, it’s not a photo ID), it is proof that your identity has been verified by an Estonian government official. Banks, incorporation agents, and so on can rely on this trust when entering into an agreement with you, which is supposed to make it easier to establish yourself in Estonia remotely.

Final words

Estonia’s simple tax regime and great e-government coupled with solid banking and relatively good geographic location makes it a fantastic country to live and run a business in.

It’s no surprise that Estonia keeps churning out great start-ups. The government is very business-friendly and shrewd.

See also

- OECD Peer Review of Estonia (also has a list of TIEA and DTA)

- FATF documents on Estonia

Question about distribution of profits. Say you make 100K first year, you take nothing out. Second year your company is dormant and you decide to take the 100K out. Corporate tax should be due on the full amount and not just current tax year profits, correct? If so Estonia would only make sense for something like a holding company cause ultimately you get to pay the 20% corporate tax on all your income from day 1.

The taxation is on distributed profits and the liability occurs at the moment of distribution. It doesn’t matter when it was earned.

Estonia is not a zero-tax jurisdiction. The tax regime does however create an incentive for re-investment and growth, which is the goal.

In most other jurisdictions, the profits would have been taxed both the first and the second year. Estonia lets you pick and choose when you want the tax to be incurred.

Thanks for finally doing a spotlight article on Estonia! I’ve been keeping my eyes on the country for some time, and I’ve enjoyed your previous articles on the subject. I actually went there myself last month to document my experiences trying to open bank accounts in SEB, Swedbank and LHV as an e-Resident (as well as detailing all the practicalities surrounding the e-Residency, etc). I just published my post, and I hope it can be useful for people interested in Estonia. It’s available here: https://medium.com/nomad-gate/estonian-e-residency-ultimate-guide-banking-taxes-cc27fe39c368

PS! One small inaccuracy in your post: “Some time later, you will be able to collect your ID card.” When the e-Residency card has arrived at your selected embassy, you can pick it up right away after they have verified your passport, taken your fingerprints and you have signed a form. It might take a few days before the card becomes active though… At least this was my personal experience 🙂