It’s been a while since I did one of these, but today we will be taking a look at Panama-based Mossack & Fonseca.

Website: http://www.mossfon.com/

Offshore Services

Mossack & Fonseca is, first and foremost, a law firm and not a pure offshore service provider. Like many other law firms, they do not post offers on their websites. However, they offer incorporation in all of their offices and can facilitate with bank account in opening in most:

- Anguilla

- Bahamas

- Brazil

- British Virgin Islands

- Chile

- China

- Colombia

- Cyprus

- Czech Republic

- Ecuador

- Gibraltar

- Guatemala

- Hong Kong

- Isle of Man

- Israel

- Jersey

- Liechtenstein

- London

- Luxembourg

- Malta

- Panama

- Peru

- Samoa

- Seychelles

- Singapore

- Switzerland

- Thailand

- United Arab Emirates

- Uruguay

- USA

- Venezuela

The prices are higher than a regular OSP, with an IBC costing around 1,000 – 1,200 USD without bank account. Cost of bank account is another few hundred to a thousand, depending on bank and company.

They also offer nominees, immigration services, investment advice, yacht registrations, trusts, IP rights, and several other auxiliary services.

Due Diligence

Time to see if we can see who owns Mossack & Fonseca and whether they are licensed to offer the services that they offer.

Whois

We again start with a whois of the domain.

Domain Name: MOSSFON.COM Registry Domain ID: Registrar WHOIS Server: whois.networksolutions.com Registrar URL: http//www.networksolutions.com/en_US/ Updated Date: 2011-06-21 Creation Date: 1997-04-08 Registrar Registration Expiration Date: 2014-04-09 Registrar: NETWORK SOLUTIONS, LLC. Registrar IANA ID: 2 Registrar Abuse Contact Email: [email protected] Registrar Abuse Contact Phone: 1-800-333-7680 Reseller: Domain Status: clientTransferProhibited Registry Registrant ID: Registrant Name: Mossack Fonseca & Co. Registrant Organization: Mossack Fonseca & Co. Registrant Street: Edificio Arango-Orillac Registrant City: Panama Registrant State: Registrant Postal Code: Panama Registrant Country: PA Registrant Phone: 507-2638899 Registrant Phone Ext: Registrant Fax: 507-2639218 Registrant Email: [email protected] Registry Admin ID: Admin Name: Fonseca, Mossack Admin Organization: Mossack Fonseca & Co. Admin Street: Edificio Arango Orillac 1er Piso Admin City: Panama Admin State: null Admin Postal Code: null Admin Country: PA Admin Phone: 5072638899 Admin Phone Ext: Admin Fax: 5072639218 Admin Email: [email protected] Registry Tech ID: Tech Name: Network Solutions, LLC. Tech Organization: Network Solutions, LLC. Tech Street: 13861 Sunrise Valley Drive Tech City: Herndon Tech State: VA Tech Postal Code: 20171 Tech Country: US Tech Phone: 1-888-642-9675 Tech Phone Ext: Tech Fax: 571-434-4620 Tech Email: [email protected]

This tells us that the domain has been around since 1997. The address in the whois does not match the address given on their website. For a company this size, it doesn’t really matter.

Corporate Structure

First up, we go to the Panamanian public records of companies, which is called Registro Público de Panamá. You will need an account to search for company details. It’s free. Unfortunately, it’s almost entirely in Spanish.

Since Mossack & Fonseca is a Sociedad Anónima (private company), its shareholders are not on public records. This is nothing unusual, but it limits the scope of information we can retrieve from the public records.

Like many larger companies, Mossack & Fonseca has divided itself into multiple legal entities.

Two of the companies are dated 1988: Mossack Fonseca Inc and Mossack Fonseca & Co Trading Inc.

One Jurgen Mossack and one Ramon Fonseca appear in different positions across the boards of directors and secretaries for the group’s companies.

Licenses

I did this once a few years ago for all of their offices. I wish I had saved all the data and could just put it here, because it’s as impressive as it is exhausting. However, I will go through and verify that Mossack & Fonseca are indeed licensed in a couple of the most popular jurisdiction.

Direct links will be included where available. Otherwise just visit the relevant FIU website and search for yourself to confirm. See Links for addresses to FIU websites.

Bahamas

The Bahamas Financial Services Board (BFSB) lists Mossack & Fonseca as an entity licensed to perform corporate services.

British Virgin Islands

According to the BVI Finansial Services Commission (BVIFSC), Mossack & Fonseca holds multiple licenses.

MossFon Trust Corporations holds a license as Authorised Custodian.

Mossack Fonseca & Co. (B.V.I.) Ltd. holds a Class I Trust Licences – Registered Agent Status license.

MossFon Authorised Representatives (B.V.I.) Limited holds a license as Authorised Representatives.

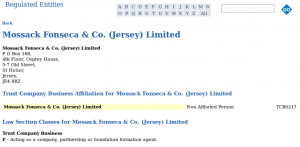

Jersey

The Jersey Financial Services Commission lists Mossack & Fonseca as being authorized to perform Trust Company Business.

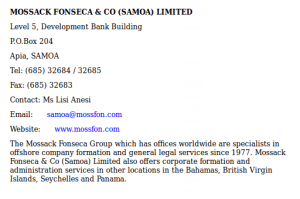

Samoa

Mossack & Fonseca Co (Samoa) Limited is one of nine licensed trustee companies, according to the Samoa International Finance Authority.

Seychelles

The Seychelles International Business Authority (SIBA) lists Mossack & Fonseca as an ICSP (International Corporate Service Provider).

http://www.siba.net/index.php?s=links-icsp#icsp39

They are also a licensed FSP (Foundation Service Provider).

http://www.siba.net/index.php?s=links-fsp-fre#fsp13

Conclusion

We can conclude that Mossack & Fonseca is as transparent as can be reasonably expected. They are licensed in a wide range of offshore jurisdictions, with physical offices all over the world. Their prices are higher than their competitors, but their target audience isn’t one that scrapes the bottom of the barrel for the cheapest deals.

With Mossack & Fonseca, you get excellent service at a fair price. I have used them for many years now and will continue to use them for years to come.

Thank you so much for your comment. I get it now.

Another thing –

Let’s take a hypothetical example:

Let’s say I live in Hungary and want to incorporate a company in Seychelles or Panama – which are jurisdictions with no TIEA with HUngary (I might be wrong about the TIEA but its just for example sake).

If I go with a local provider (who could be a reseller or not) to incorporate my company, would be any secrecy risks like the information get passed through the Government? Taking this in account, would it be better to skip the local providers and go directly with some foreign provider that is not locally in my country of residence to skip the risk of information leak?

I wonder what’s your say on this. Athough, it might be possible that my concern is unfounded and there cannot be any information leaks to my local Government….I am just thinking that it would be very easy for the local Government – local Financial Unit to come to the local OSP and do some investigation and find all kinds of information (For example when I pay for the service – the invoice will remain in their accounting)…Only possibility is that the local provider is not incorporated in my country of residence and has only local offices here?

I am really anxious to find out because I need to know whether I go with a local OSP or go through the fuss of finding a foreign one and send the papers through courier etc.

Thank you very much Streber

Hi Victor,

This is a tricky one to answer as there aren’t a whole lot of similar cases to compare against. Local law may also vary significantly on the subject.

If your local OSP is a law firm, they may be able to provide a hightened degree of confidentiality if your country applies some form of attorney/client confidentiality privilege which cannot be overridden for tax matters.

Otherwise, I doubt a local OSP would be able to provide you with secrecy so strict they would not comply with a request for information from a government authority or law enforcement.

The lack of a TIEA between Hungary and Panama or Seychelles would be irrelevant if the information can be extracted from within Hungary.

Excellent answer.

Thank you very much

Are there any OSP’s that have a Confidentiality Privilege – conferred in legislation by a jurisdiction – similar to an Attorney/Client Confidentiality Privilege? I would think that in offshore jurisdictions where these services are the bread-and-butter of their national economies that some sort of confidentiality privilege would be contained in the governing legislation for these services. I can’t imagine there is much in the way of a “bar association” in Samoa and the Cook Islands. Or could one be protected by an onshore Attorney/Client Confidentiality Privilege for a Samoan IC, using let’s say a Canadian law firm?

Hello Streber,

Probably you heard it a million times, still…once again – congratulations for the blog and the exquisite info that you provide.

One question I have to ask you – from what I read, you sometimes talk about the resellers and licensed OSPs. Can you elaborate more on the subject?

I understand that when you want to incorporate, best is to talk with a licensed international OSP that is licensed also maybe in the Jurisdiction you want to incorporate. What if, for exchange you want to talk to a local OSP for incorporation, and when doig your due diligence you find out it is not licensed in the place where you want to incorporate. This means it is a reseller and buys the service from a licensed OSP, right? Otherwise it cannot provide the services it says it does. In this case, it makes no sense to talk to the reseller when you can go directly to the OSPs which are licensed in that particular jurisdiction, right?

Another question – lets suppose you find a good international OSP and you cannot find it licensed when you search in the SEychelles (SIBA directory). Does this mean it collaborates with someone licensed there and acts as a reseller for that particular jurisdiction? Does it still makes sense to go with the international one ALTHOUGH it is not licensed in that jurisdiction?

Thank you very much,

I appreciate you time and looking forward to what you have to say

Good luck with your blog!

Hi Victor,

Thanks for your comment!

I will address this in an upcoming post where I will go through some less known aspects of OSPs. Resellers aren’t inherently bad and there are no guarantees that licensed trustees/company managers provide a better service.

However, someone who is licensed can be held accountable more easily than a reseller who is operating behind the thick secrecy veil of an offshore company. You can even turn to the jurisdiction’s financial services commission with complaints. There is no guarantee that they will respond but FSCs in reputable jurisdictions tend to be responsive and react.

It is correct that if the company does not exist in the FSC registry of license holders it is reselling someone else’s services – with one exception. It could be that the company is either very recently licensed or is operating under a pre-approved license which is not yet published. A good company would be happy to answer this to verify your concern. You could also try contacting the FSC.

Whether it makes or not is harder to answer. If they are licensed in several other jurisdictions, they have likely chosen their partner very carefully and might still be able to offer a good service.

Yes, it means it is reselling someone else’s services.

It can make perfect sense to go with that operator anyway. That decision is entirely in your hands. For example, some resellers are able to focus on building a strong network of banking contacts or leverage their various suppliers’ banking connections, whereas some license holders have to dedicate significant resources to compliance and have a narrow banking network.

I don’t want to make it sound like resellers are always bad and license holders are always bad. I have just come to prefer license holders in most cases, but for example Kaizen is a notable reseller doing a good job.

Hi Streber…..

I’m new to all of this so your blog/site is great. thanks. One minute an offshore sounds not too complicated, the next it sounds a potential nightmare. I simply need help in the first instance – where to go for advice… If I go to an accountant – most don’t have expertise in offshore or highly advise not to do it you won’t save anything in the long run everyone transaction is traceable and look at you like you’ve just robbed a bank. I know you say you can’t consult through blog but have you reviewed any UK companies or accountants/lawyers that can advise in UK or London?…Or Is it better to use a lawyer in the chosen country to sort it all? Having read a lot st Lucia sounds ok, but Monaco might be just as good and it’s a bit nearer. Sorry to be so green, Im not a financial person,

There are tonnes of lawyers and accountants in the UK and London. Appleby, Baker Tilly, Jordans International, and Intertrust just to mention a few of the bigger names, aside from the Big Four: PwC, KPMG, E&Y, Deloitte. As long as what you are doing is legitimate, it shouldn’t be a problem to get one of those to help you out.

They have offices across the world and can provide specialized legal advisory in certain jurisdictions.

Ok understand. Unfortunatley, a problem I have recently encountered is the unwillingness of some of these service providers to open an offshore bank account for a US Citizen who is a beneficiary of a Cook Islands Trust. Any recommendations or advice on this issue? Thanks in advance for posting the info you have provided so far.

I’m afraid not. Due to the compliance nightmare of dealing with US persons, I have never taken US clients and as such never had a reason to investigate opening bank account for US persons.

To squaretrades: I think that if you had used the service provider, that you refer to, to open the Cook Islands Trust, then they would have helped you to open a bank account, too. Have the service provider create an LLC and open a bank account in the name of the LLC. The Cook Islands Trust would be the owner of the LLC.

hello Streber: are you available for a consult? I couldn’t find your contact info anywhere…

Hi,

While I do consulting, I can unfortunately not take on clients through my blog, which is why there’s no contact information.

Hopefully you can find the answers you seek through the offshore service providers I’m reviewing. More are coming in the future.